2025 Tax Brackets Married. Tax rate taxable income (single) taxable income (married filing jointly) 10%: In this article, we will explore the tax brackets for married couples filing jointly in 2025 and 2025, providing you with valuable insights to navigate the tax landscape.

To start, single tax filers must have modified adjusted gross. They are $14,600 for single filers and married couples filing separately,.

For single and married people filing individually, their standard deduction increases by $750 to $14,600.

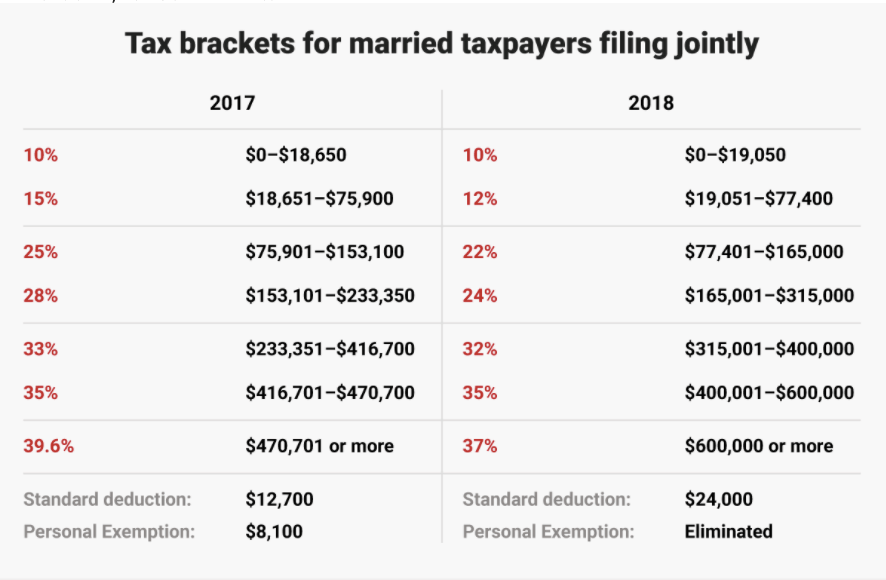

2025 Tax Brackets Announced What’s Different?, 10%, 12%, 22%, 24%, 32%, 35% and 37%. For the 2025 tax year, the standard deduction will increase by $750 for single filers and those married filing separately, $1,500 for married filing jointly, and $1,100 for heads of household.

tax brackets for married Laura Clark, 2025 federal income tax brackets; Instead of the standard $174.70.

Tax Filing 2025 Usa Latest News Update, Single filers and married couples filing jointly; Below, cnbc select breaks down the updated tax brackets of 2025 and.

2025 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, Tax rate taxable income (single) taxable income (married filing jointly) 10%: For example, in the 2025 tax brackets, a single filer will encounter the 10% rate from $0 to $11,600, and the 37% rate kicks in at incomes over $609,350.

Tax Season Guide Married Filing Jointly vs. Separately Chime, 2025 federal income tax brackets; See current federal tax brackets and rates based on your income and filing status.

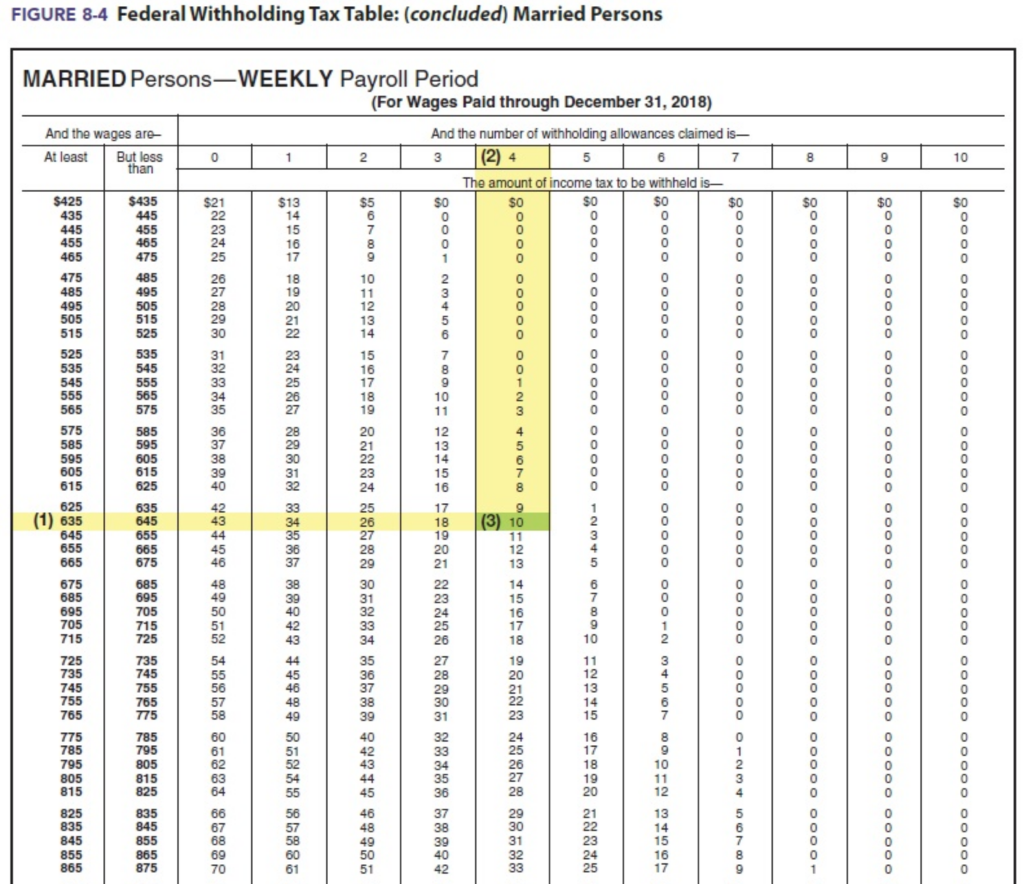

Married Federal Tax Withholding Table Federal Withholding Tables 2025, For single and married people filing individually, their standard deduction increases by $750 to $14,600. Income falling within a specific bracket is taxed at the rate for that bracket.

Federal Withholding Tables 2025 Federal Tax, Rates for married individuals filing separate returns are one half of the married filing jointly brackets. 2025 federal income tax brackets;

Stern Kory Sreden & Tax Planning Guide 2025 Tax Planning, The irs uses different federal income tax brackets and ranges depending on. Single filers and married couples filing jointly;

50 Unveiled Benefits of Married Filing Separately Ultimate Guide 2025, Gains on the sale of collectibles (e.g.,. 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

Tax Rates 2025 To 2025 2025 Printable Calendar, The irs uses different federal income tax brackets and ranges depending on. 2025 federal tax brackets married filing jointly, 8 rows estimate your 2025 taxable income (for taxes filed in 2025) with our tax bracket calculator.